The need to take card payments online and off has become paramount for the modern business. However, to do that requires payment processing, usually supplied by merchant service providers.

This can come in the form of a card reader for physical PoS (Point of Sale) transactions, in which even an app on your phone or other mobile device can run the transaction through. Additionally, or alternatively, you can also get credit card processing to run through an ecommerce site.

PoS processing fees tend to be cheaper, on the grounds that the customer is physically present and so the chances of fraud are less than anonymous online transactions. However, for PoS processing in a bricks and mortar store you may need to pay for additional equipment, not least the card reader itself.

Fees can also vary according to sales volume, and it's worth keeping an eye on transaction fees. While some merchant services may charge seemingly high monthly fees, these often come with very low individual transaction costs that make them very competitive.

Overall, the market for merchant services is a competitive one, and there's plenty of choice out there. The challenge is to find one that works best for your business model. To help you, we've identified the best in merchant services for both online and offline businesses.

- We've also highlighted the best payment gateways of 2019

Want your company or services to be added to this buyer’s guide? Please email your request to desire.athow@futurenet.com with the URL of the buying guide in the subject line.

Image Credit: Helcim

Helcim offers an array of merchant services, including the obligatory credit card processing, merchant accounts, along with credit and debit terminals.

The company also distinguishes itself with multi-currency processing, and international card processing for businesses that operate overseas. As a show of confidence, Helcim is one of few companies that offers a 30-day free trial of its service.

The firm’s transparency when it comes to fees is appreciated, with the Retail plan costing $ 15 monthly, and the Online offering is $ 35 per month – although if you happen to be a business that does commerce in both spaces, there’s no bundle discount for taking both plans.

There are also additional fees that vary by volume. For example, a retail merchant with less than $ 25,000 in monthly volume pays a low additional 0.25% plus $ 0.08 per transaction.

Image Credit: Payline

Payline is a merchant service that promises to make it easy to accept credit card payments, and offers a variety of plans to suit any company's needs. It offers a variety of services including mobile, online, in-store, enterprise and integrated payments, and also Payline Medical for the healthcare field, and business loans as well.

Payline offers a Payline Gateway, that can be used as a plugin on a business website to accept payments, and also a ‘virtual terminal,’ that is used to manually enter payments received over the phone or through the mail.

Payline offers pricing based on the service. A swipe falls under Payline Start, which has a $ 10 monthly fee with an additional 0.2% per transaction, which now includes AMEX as well – note there is an additional $ 0.10 per transaction fee here.

For a keyed-in, or online transaction, Payline Connect is also $ 10 monthly, with a more expensive 0.3% plus $ 0.20 per transaction, with AMEX also included. With Payline Connect there’s a further option for the aforementioned Payment Gateway for an additional $ 10 monthly fee.

Image Credit: QuickBooks

QuickBooks Payments is another option worth considering, as the company has expanded from simply providing accounting software to the arena of online payment processing, and now full merchant services.

Options include a card reader for store purchases, phone payments, and online processing. What is especially useful is its direct integration into the QuickBooks accounting software, which means even POS purchases appear immediately in your accounts in real-time.

Charges are provided upfront and are relatively straightforward. There's a Pay-as-you-Go payment plan with no monthly fee, with transactions charged at 2.4% + $ 0.25 per swipe, dip, or tap, or 3.4% + $ 0.25 for keyed-in entries.

However, there is also a Pay Monthly subscription option available for desktop users, which costs $ 20 per month and reduces card swipe transactions to 1.6% + $ 0.30 and may especially benefit volume users. A free card reader is provided at sign-up for taking card payments, but if you'd also like to be able to deal with NFC payments from Apple or Android devices, you will need to buy the all-in-one card reader for $ 49.

Image Credit: PayPal

PayPal Merchant Services is the business version of the ubiquitous online transaction tool, and it claims to be in use with over 17 million firms.

It features the secure transactions that PayPal is known for including fraud protection and risk modeling, a customer service team, and allows a variety of payment methods including mobile and in-store credit cards. Logically, it also provides support for acceptance of PayPal from its 200 million account holders.

The service is better suited for a lower volume of transactions, and especially well developed for ecommerce. With no monthly fees the service is attractive to online start-ups and small businesses.

With a transaction fee of 2.9% plus $ 0.30, the service is competitive with similar services, though this may not be so true with higher sales volumes.

Image Credit: Square

Square (previously known as Square Payments Processing) is a merchant service designed to “start selling fast”. It will attract smaller and new businesses starting out with its promise of quick setup, no long term contracts and no monthly fees, and even includes a free mag-stripe reader.

Square offers a robust feature set including being able to send invoices (even from a mobile device) to customers for payment, storing the card information for regular customers, plus support for third-party e-commerce platforms such as Wix and Ecwid. It also boasts the ability to take keyed-in payments directly via the Square Virtual Terminal without a card reader, and an offline mode for those occasions when an internet connection is not available.

Square further offers a variety of card reader hardware, beyond the free mag-stripe reader, such as paid devices that can handle card chips, and NFC payments.

The pricing is simple, with a single tier, and only transaction fees. For a “swipe, dip or tap,” the cost is a fixed 2.75%, and keyed-in transactions are a steep 3.5% plus $ 0.15 per transaction.

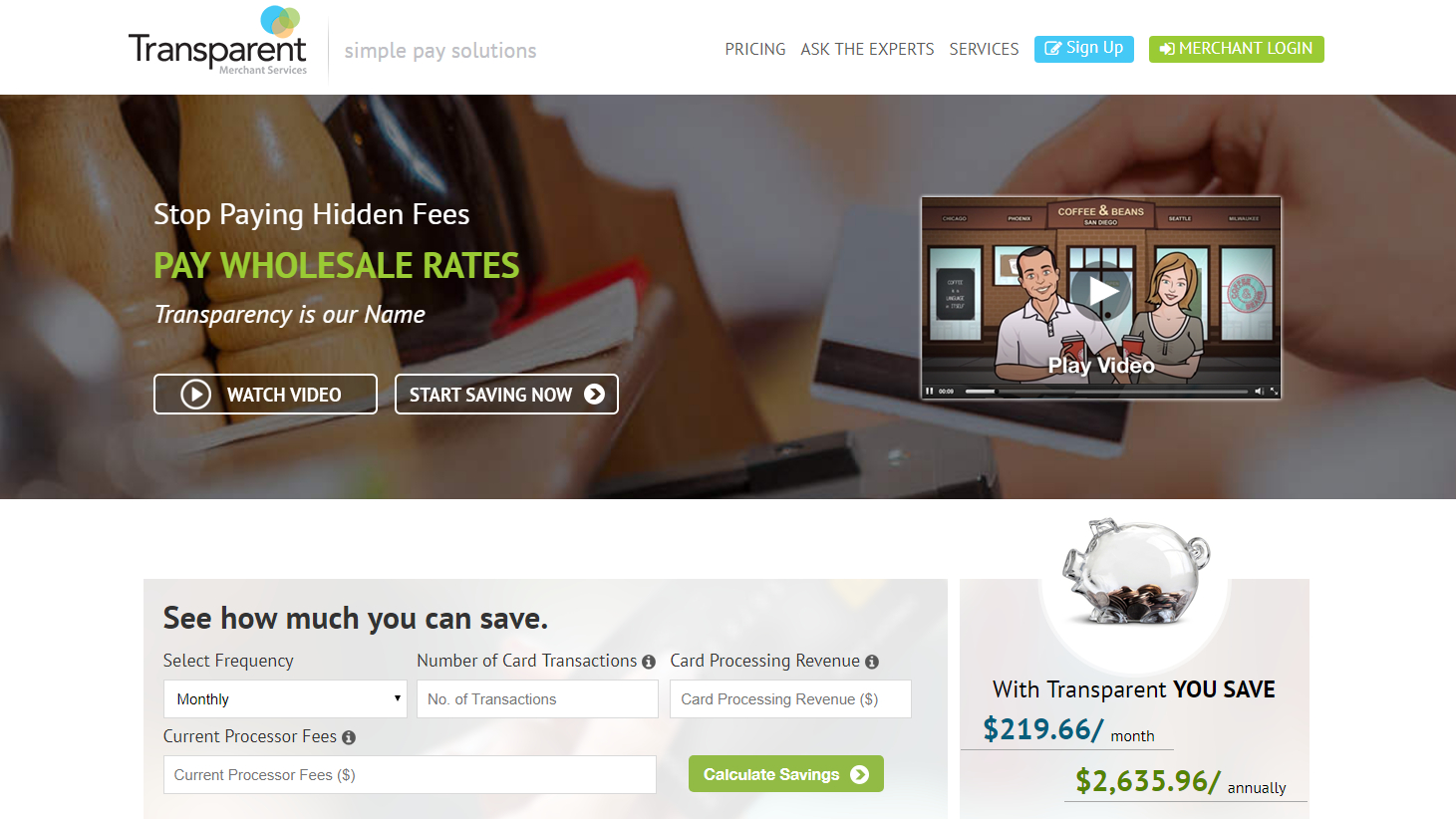

Image Credit: Transparent Merchant Services

Other merchant services to consider

Transparent Merchant Services offers a wide range of payment services for a monthly fee which starts from $ 49.97 for up to 500 transactions per month. Although that might sound a little high, this comes with interchange-plus pricing, which means each transaction costs cents, and could especially benefit those businesses charging for higher-worth products or services.

Fattmerchant offers a comprehensive suite of merchant tools for all payment types and situations, and has an especially good POS offering. It does charge $ 99 per month, but transactions are charged at interchange fees with no mark-up. This cost-plus pricing model means no high fees even for phone transactions, so costs can scale really well with volume compared to other providers.

Flagship Merchant Services allows business owners to take credit card payments online, in store, on the go, or over the phone. There are a range of pricing models available, but unfortunately Flagship is not transparent about fees on its website. However, Flagship won't hold you to a contract term and you can cancel at any time.

Dharma Merchant Services promotes itself as a low-cost, low-fee merchant service that can provide credit card processing in-store and online with a POS, virtual terminal, and even a mobile app. While the company does list its processing fees on the website, cost for the POS terminal and card readers aren't provided so you'll need to ask directly about those.